Spending Less Can be a Pathway to Financial Peace — and Self-Love

Written by Sarah Treleaven

Published on May 16, 2022

minute read

Share:

For some of us, it's battling inflation; for others, it's coming to terms with pandemic-era spending habits. Either way, a lot of us are reviewing what we spend on. But it's not just about cutting out luxuries; it's about determining what brings value to your life.

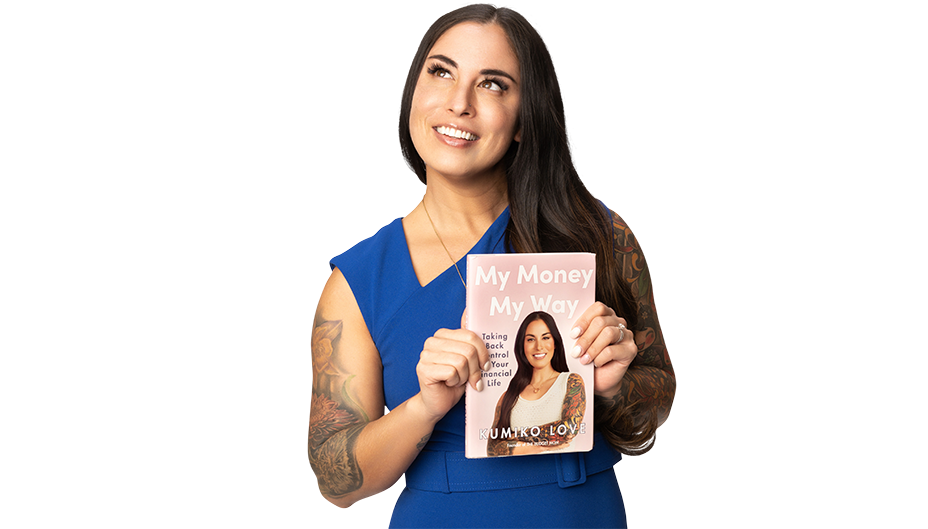

Kumiko Love, accredited financial counselor and author of My Money, My Way, says that setting a budget doesn't have to leave you feeling deprived. Instead, spending with greater intention can enhance your overall well-being.

When a lot of people think 'budgeting,' they think dollars and cents. Is that all there is to it?

This journey of spending less is not about the dollar amounts; it's about what we're trying to accomplish with our money and what brings joy to our life. So, it's about cutting back on the things that don't bring value versus spending more on things that are truly important.

So, it makes sense to look at budgeting holistically and through a value lens?

Budgeting is about honouring you. You get to say what's important and where your money should go. That is such a builder of financial confidence!

You can consider budgeting a process of self-discovery. The more you grow to understand about yourself, the better spending decisions you can make. People say to take emotions out of finances, but my financial philosophy is all about using emotions as a motivational tool. When you're doing “robot work" — meaning, doing things that other people dictate — you can hit all these goals and feel absolutely nothing. My budget has to be based on how I define success for myself.

When evaluating spending, how do you decide what you consider a luxury, a nice-to-have or a must?

The distinction between those things is very personal. One person might say that they "need" a new car because they need to take the kids to daycare and themselves to a job. Another might say that they "need" a new car because they want something nicer-looking.

I think it's sometimes easier to identify a need when it's not being met. If your life would spin into chaos without it, then it's a need. You have to think about each item in terms of the consequences of not having it.

How do those categories help people to feel empowered instead of deprived?

Empowerment comes with realizing what we're truly fighting for. People might say, well, I'm empowered when I save this much money, or when I pay off this much debt, or put this amount in their retirement account. But what they're really saying is, I feel empowered in preparing for a future I desire. Not having to stay at a job. Not having to stay in an abusive relationship. Being able to pursue a passion project. It's about a way of living.

Do you have any tips for putting those decisions to work and the actual act of cutting back spending?

I call this exercise “the flow" and here's how it works:

First, what are my fixed expenses? I make a list of the monthly things I have to pay, like car insurance, rent and daycare.

Second, I take my income minus those fixed expenses, and that's the money for variable expenses. They're the hardest to predict, but we also have the most control over them. You review your spending and determine each item's value. You might see that you're spending $1,000 a month on eating out. And then you ask, is spending that amount serving me?

Third, consider big-picture goals: Do you want to tackle debt, or savings, or investing? But the key is to start from a place of honesty, no matter how much you don't want to see those numbers. Starting from a truthful place allows us to make small, incremental changes. If you create a budget based only on where you want to be, you're setting yourself up for failure.

This is all about being all honest with yourself.

I call it a “slap-in-the-face" moment. When my community members come to me after they finish this step, they're like, "Holy crap, I did not realize I was spending $800 a month on clothes." It's a slap in the face to learn that you're spending so much on things that don't necessarily serve you. It's very powerful. You can't change what you don't know when you're creating a budget.

Have you ever had to cut down on spending for a trade-off that was worth it?

After I got a divorce, I went on a spending spree. I would tell myself that I just needed time to myself, and I would end up at the mall, putting purchases on my credit card. It took me years to be able to say that I was overspending because I didn't like how I looked. This was a very hard realization, but I challenged myself to stop spending on my outside appearance for a year — no makeup, no tanning, no new clothes — to focus on my natural self. In the process, I learned to love every aspect of myself. And I started to channel my spending towards things that really did matter, like memories and experiences with my family.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Explore More

Should I Invest or Pay Down My Mortgage?

Consider these four questions

minute read

As Many Head Back to the Office, Where Could Investors See Changes?

How returning to in-person work could affect a range of investments

minute read

Considering the FIRE Lifestyle? Here’s What Your Investments Might Look Like

We asked three people how they created financial independence and retired early

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.