Automate to Accumulate: How Consistency Can Help Drive Investing Success

Written by The Inspired Investor team | Published on November 24, 2023

Written by The Inspired Investor team | Published on November 24, 2023

This article was produced with files from RBC Global Asset Management.

We all hope to retire with enough money to enjoy a secure and enjoyable retirement. For some, that might mean heading south each winter; for others, spending more time with family. How you spend your retirement is a personal decision. But the question is, how can you set up your finances in a way that can help you save and invest enough to comfortably retire on your own terms? The short answer: consistency. Automating your contributions is one way to ensure that your savings are taken care of – so that you can focus on investing. And one thing we can all agree on is that taking control of your finances feels good.

PAC: Set It and Forget It

A regular investment plan allows you to choose when, how often and how much you contribute to your investments throughout the year. This helps ensure that your savings goals remain a priority throughout the entire year, and not only during certain periods – like the yearly RRSP contribution deadline that causes a flurry of last-minute transfers. Setting up a pre-authorized contribution plan, also known as a PAC, let’s you automate your savings so you don’t have to think about it regularly.

The contribution generally comes from your chequing or savings account and, once set up, the funds are transferred without any additional effort by you. These automatic contributions to an account of your choice — typically your Registered Retirement Savings Plan (RRSP), Tax-Free Savings Account (TFSA), Registered Education Savings Plan (RESP), First Home Savings Account (FHSA) and/or another investment account – can really add up. Even more so if you gradually increase the amount you contribute each year or when your income goes up.

Plus, at RBC Direct Investing, setting up a PAC can help you save on fees. With just $25 a week or $100 a month, you also get your quarterly maintenance fee waived.1

Benefits of Consistency

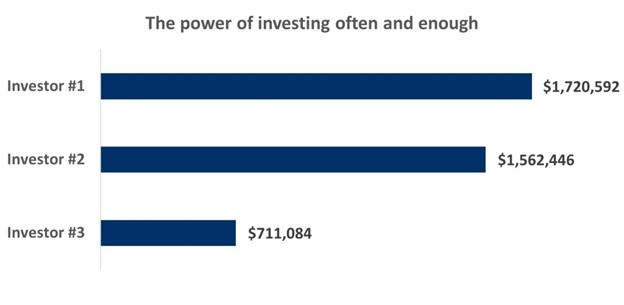

Let’s explore this further and examine how different choices investors make can change the amount of wealth that accumulates over time.

Here are three hypothetical investors who invest in markets at the end of each month. They all started a PAC in January 1990 and each investor takes a different approach.

Source: RBC GAM, Morningstar. Performance based on hypothetical investments in the S&P 500 Total Return Index USD. For the period of January 1, 1990 to June 30, 2023. Investor #1: Invests $250 each month and increases this amount by $250 every 5 years. Investor # 2: Invests $250 each month and increases this amount by $250 every 5 years until they reach a $1000 contribution per month. Investor # 3: Invests $250 each month. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results. An investment cannot be made directly into an index.

Key takeaways for investors

Even though the results varied in the examples above, they all stuck to their investment plan. This consistency is one of the keys to success. While unexpected life events are inevitable and financial plans may have to shift at times to meet changing needs, sticking to a schedule and boosting your contributions incrementally over time increases your chance of meeting your long-term retirement goals.

Setting up a PAC is also an opportunity to take advantage of dollar-cost averaging (DCA), an investing strategy that can help you reduce risk by avoiding attempts to “time the market” in favour of investing at regular intervals. As Warren Buffet once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Looking to set up a PAC at RBC Direct Investing? Visit Pre-Authorized Contributions or log in and head to Transfers under Trade & Transfer.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2023.

1 There is no quarterly maintenance fee charged if your combined assets are $15,000 or more across all of your RBC Direct Investing accounts. If your combined assets are le ss than $15,000 across all of your RBC Direct Investing accounts, you will be charged one maintenance fee of $25 per quarter (split across all of your accounts). For full details please refer to the complete Commissions and Fees Schedule at www.rbcdirectinvesting.com/fees.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Here’s what we saw on the trading floor in March 2025

Making these projections might seem like a black art, but there’s science behind it too

Here’s what we saw on the trading floor in January 2025