Here Are Your Company Balance Sheet Crib Notes

Written by The Inspired Investor Team

Published on May 9, 2024

minute read

Share:

For investors, a company balance sheet can provide important information when considering investing in a company. It provides a snapshot of the company’s assets, liabilities, and shareholders’ equity.

Learning how to read a balance sheet is a core skill to learn because it can help you determine whether a company is moving in the right direction. Understanding a company’s debt load and its borrowing costs are important to consider before buying shares of a business. That’s especially true in today’s higher interest rate environment, where the cost of debt is high. A high amount of debt can eat up profits. Some debts however might be desirable. For instance, businesses investing lots of capital in new technology or exploration projects might be exceptions to the rule.

What is a balance sheet?

A balance sheet is a financial statement that lists a company’s assets and liabilities. Understanding this statement is a must for investors interested in trading. The way a company structures its balance sheet and the amount of interest it pays on its debt can significantly affect a business’s cash flow, which ultimately affects the price of the stock, now and in the future. Company balance sheets, which are updated quarterly and annually, can be intimidating at first glance, but the premise behind them isn’t much different from how you might track your own assets and expenses at home.

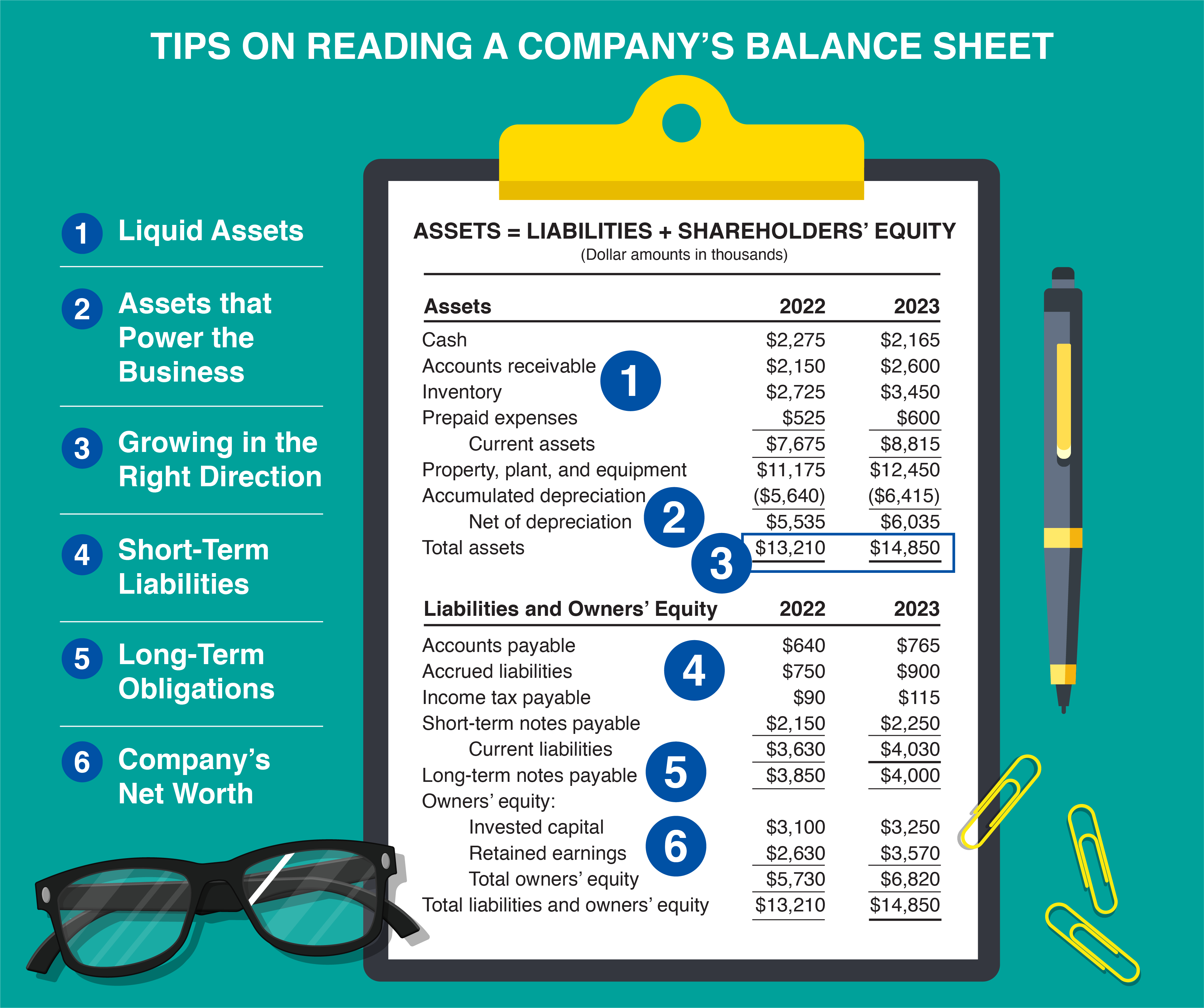

Here’s a look at what the different sections of the balance sheet represent and how to interpret the information you find there.

1. Liquid assets

Current assets include cash and other assets that can be converted to cash within a year, such as inventory, investments and accounts receivables. This part of the balance sheet can help you determine if the business can pay its bills without raising funds, sometimes referred to as its liquidity.

Pro tip: The current ratio, which divides the company’s current assets by its current liabilities, is one way to measure liquidity – the higher the number, the better.

2. Assets that power the business

Businesses make money by selling products and services, but they also need to retain some assets to operate. Non-current assets are long-term investments in things like property, patents, trademarks and equipment. These are core to the business and have value, but they are harder to sell.

3. Growing in the right direction

Is the company growing its assets year over year? If you see a decline here, it might be worth investigating further to find out why.

4. Short-term liabilities

It costs money to make money. An increase in short-term liabilities, like accounts payable, income tax, financing and payroll, could mean the company is facing more pressure to find cash to cover its obligations.

5. Long-term obligations

These are liabilities that are due a year or more out. These may include loans, bond repayments, leases and pension provisions. A sudden increase in this part of the balance sheet can be a sign a company has increased its borrowing obligations, which can sometimes increase the risk of default.

6. Company’s net worth

Determining the value of a business is similar to how you calculate your own net worth by subtracting liabilities from your assets. It consists of money that shareholders have contributed to the business (usually in the form of shares) and earnings that the company has generated over time that have been retained in the business.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2025.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Explore More

5 Ways to Get More Out of Your RESP

How can you make the most of this investment vehicle? We explain.

minute read

There's an ETF for That!

Find out more about the options that are out there

minute read

ETF Trends from the RBC Capital Markets Trading Floor – May 2025

Here’s what we saw on the trading floor in May 2025

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.