Here's What a Watchlist Can Do For You

Written by The Content Team

Published on December 19, 2018

minute read

Share:

The holidays are a great time to review your investing progress, reassess your goals and create new ones. As a "gift" to yourself, why not make a list of stocks to watch for the new year? It can be an opportunity to enhance your research skills, learn about different companies and, potentially, find new investments for your portfolio.

Watchlists are an efficient way to keep an eye on stocks, exchange-traded funds (ETFs) and/or mutual funds you've already invested in, and those you want to learn more about. They can be a simple way to follow a company's stock performance, financial results, news releases, media mentions and analyst ratings, all in one convenient location.

Creating Your Custom Watchlist

With securities information publicly available online, we can get up-to-the-minute information throughout the trading day. Here are a few places to consider setting up your customized watchlist:

Your trading platform. This is a convenient option because your trading account, holdings, trading history and watchlist can all be in one place.

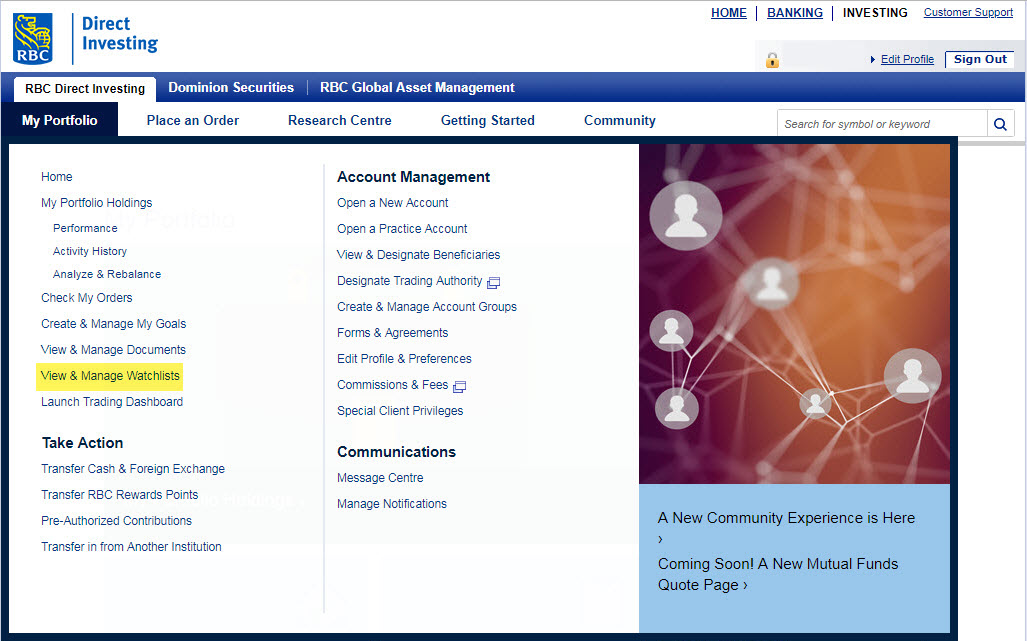

At RBC Direct Investing, for example, View & Manage Watchlists under My Portfolio allows you to create new watchlists and edit existing ones.

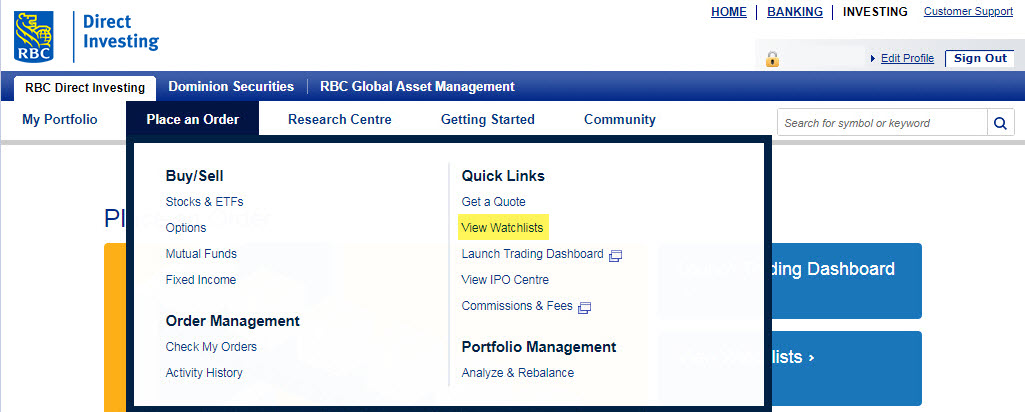

You'll also find your watchlists under the Place an Order tab...

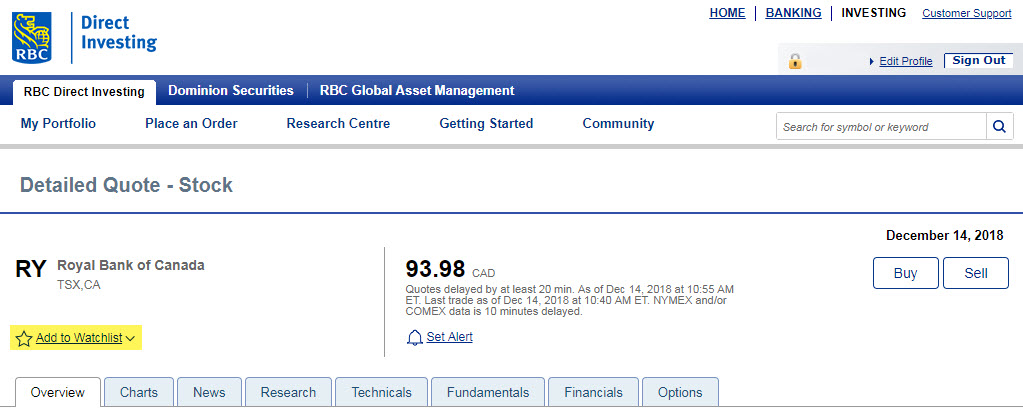

...and through a Detailed Quote.

Business media websites. Many major media outlets offer watchlist capabilities, with varying degrees of detail. Some are free, while others cost money or require you to buy a subscription. Some paid sites offer free watchlists, up to a certain number of stocks.

Stand-alone apps. Investors can also download independent mobile apps to create watchlists.

Who Should Be on Your Watchlist?

This is where the fun begins. It may be wise to start with a focused list of companies that you can reasonably review on a daily, weekly or monthly schedule. Adding hundreds of stocks may seem like a good idea, until you realize the amount of time it will take to review all that information. There are a number of ways to organize watchlists — all dependent on your personal portfolio needs. Here are a few common approaches:

Sector or industry. Creating watchlists based on specific sectors can help you keep an eye on how certain industry players are doing, or help you familiarize yourself with industries you want to learn more about.

Geography. You may be considering global investment ideas, in which case you can create a list or lists of global stocks of interest.

Investments of Interest. You may be hearing certain names out there and are considering them as possible investments, but want to follow them for a while. A watchlist of potential opportunities can give you a better sense of whether they'll be right for you.

Benefits of a Watchlist

Placing a stock on your watchlist gives you easy access to a huge amount of material about a company or investment that would otherwise take time to find. Depending on the investment type, you'll get access to quote information, including prices, volume, 52-week high and low details, and fundamentals like P/E ratio. You can also dig further into detailed quotes for analyst research and latest news related to companies.

Watchlists can also add discipline to your investing habits. They let you to stay in the know about a company, and a regular flow of information can help you make better-informed decisions.

As 2018 comes to a close, setting up a custom watchlist can be a simple, risk-free and effective (plus fun!) way to kick-start your investing habits for the year ahead.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2018. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Images are for illustrative purposes only.

Explore More

5 Ways to Get More Out of Your RESP

How can you make the most of this investment vehicle? We explain.

minute read

There's an ETF for That!

Find out more about the options that are out there

minute read

ETF Trends from the RBC Capital Markets Trading Floor – May 2025

Here’s what we saw on the trading floor in May 2025

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.