Playing Catch-Up With RESP Contributions & Grants

Written by Lisa Rostoks

Published on November 15, 2017

minute read

Share:

Let's face it, it's hard to imagine your newborn studying Shakespeare when you're more focused on changing diapers and establishing a sleep schedule.

Besides newborn duties, competing priorities for some of us, like rent, a mortgage or daycare costs, can also put Registered Education Savings Plan (RESP) contributions on the back burner.

Fast-forward a few years, and suddenly you realize those post-secondary years are approaching far more quickly than you expected. Maybe you've now got an 8-year-old, or (gasp) even a 14-year-old, and you've contributed exactly $0 to an RESP. That's right...zilch! What now? Is it too late? We get it, time goes fast, but it's not necessarily too late.

RESPs offer a way to "catch up" on education savings if you didn't get started right away. All may not be lost! Here's what's involved:

Not Losing Out: That Precious Grant Money

Besides offering tax-deferred investment growth, RESPs have another benefit that can be leveraged. Through the Canada Education Savings Grant (CESG), the most common of the government grants available, you can add to your RESP savings.

The Basics

- What You Get: The basic CESG provides 20 cents on every dollar you contribute to an RESP, up to an annual maximum of $500. So, if you put in $2,500, you'd be eligible for the full $500 in grant money available each year.

- Limits: The maximum amount available under the basic grant is $7,200 per child.

- The Carry-Over Feature: If you don't get the full grant amount each year, any unused grant room accumulates and carries forward until the year a child turns 17. You can go back one year at a time to make up for missed contributions.

Carrying Forward Contributions

If you've delayed starting an RESP or haven't been able to contribute enough to get the maximum grant amount each year, you may still be able to take advantage of that "free" government grant money.

The carry-forward option effectively allows you to double up on contributions to help you catch up on missed grant money. One catch is that you can only use one previous year's worth of contribution room each year.

So, let's say you normally contribute $2,500, but missed last year's contribution altogether, which also meant no $500 grant. If your child meets the 17-year-old cutoff requirement, you could double your contribution to $5,000 this year and the government contribution would rise to $1,000 to make up for last year's missed grant.

"The carry forward option means that even if you started late or missed some years, you may still be able to receive the maximum grant amount."

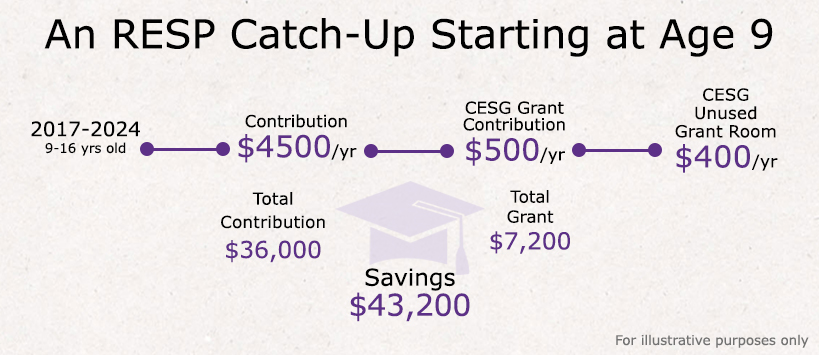

The carry-forward option means that even if you started late or missed some years, you may still be able to receive the maximum grant amount. If you decide when your child is nine years old to start an RESP and you can contribute $4,500 annually, you could still receive the full $7,200 of basic grant money within the eligible timeframe. Here's what that could look like:

Here's another example. You have a 14-year-old but haven't made any contributions to date. If you open an RESP in the calendar year your child turns 14, you could have four years to contribute and double-up on the grant amount. For example, a contribution of $5,000 annually would allow you to receive $1,000 of grant money each year ($500 for the current year and $500 for unused room from a previous year). That would mean a total grant amount of $4,000 — less than the $7,200 maximum available, but still sizable!

One important age to keep in mind is 15. In order to be eligible for any of the grant money, an RESP must be opened before the end of the year a child turns 15 and must have met certain minimum contribution levels.

This article was last updated in September 2022.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2017. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Explore More

5 Ways to Get More Out of Your RESP

How can you make the most of this investment vehicle? We explain.

minute read

There's an ETF for That!

Find out more about the options that are out there

minute read

ETF Trends from the RBC Capital Markets Trading Floor – May 2025

Here’s what we saw on the trading floor in May 2025

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.