What is Stagflation?

Written by The Inspired Investor Team | Published on May 16, 2022

Written by The Inspired Investor Team | Published on May 16, 2022

"Stagflation" is a term we haven't heard much of since the 1970s, but it has been creeping its way back into the conversation lately, causing concern for both economists and average citizens alike. So, what is stagflation exactly, and why are we hearing more about it now?

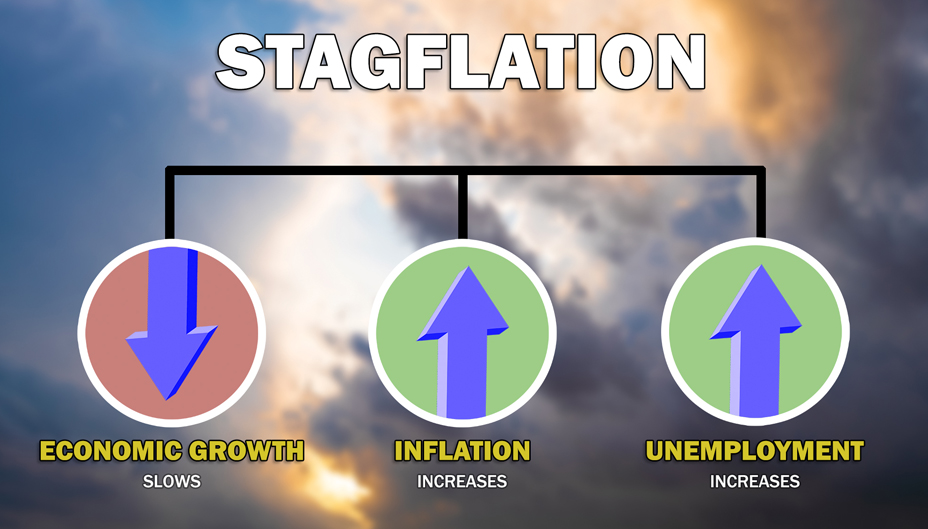

Stagflation is something of a perfect storm in economic terms, and occurs during a period that sees an unfortunate mix of slow growth within an economy, along with high levels of inflation and unemployment. Usually, these three economic forces don't happen together since unemployment and inflation rates typically move in opposite directions.

In the 1970s, however, stagflation did occur. It was during an oil crisis that saw oil prices climb sharply while supplies dwindled thanks in part to a supply embargo. This caused prices for nearly everything to go up just as sharply, which served to further weaken an already ailing economy in Canada and elsewhere. According to Bloomberg, after the 1973 oil shock, labour unions spearheaded double-digit pay raises in response to high inflation, which it said caused an economic slump and "effectively ended full employment."

Today, global economies are still reeling from COVID-19 and the uncertainties it has caused, and the ongoing war in Ukraine has sent oil prices skyrocketing. In turn, the prices for goods worldwide are climbing, which is leaving economic policymakers scrambling to bring inflation down.

For policymakers, lowering inflation by raising interest rates increases the cost of borrowing money, which can temper economic recovery. On the other hand, if they keep interest rates low, there's a risk inflation heads even higher.

Thankfully, there is some. Our economy in Canada is not tied as tightly to oil as it was in the 1970s, thanks to various initiatives designed to lessen our dependence on oil and other fossil fuels. Governments are also stepping in to subsidize rising energy costs to shield low-wage households from further hardship, after learning lessons from the last time stagflation reared its ugly head. Inflation is rising, however, recently hitting 6.7 per cent in Canada, which is the highest it has been in over 30 years. But, that's still significantly lower than in 1981, when it peaked at more than 12 per cent. And, on the jobs front, Canada's unemployment rate hit an all-time low in May of 5.2 per cent.

The Bank of Canada raised its benchmark lending rate by half a percentage point in April, to one per cent, marking the biggest single increase in more than two decades amid ongoing concerns over high inflation. The U.S. central bank also recently raised its benchmark lending rate by the largest amount in 22 years.

How do central bankers feel about the possibility of stagflation? In an interview with Bloomberg following the April rate hike, Bank of Canada Governor Tiff Macklem said he is quite certain that policymakers will be able to avoid a return of 1970s-style stagflation.

"A lot has changed since the 1970s," he said. "Central banks are going to be much more ahead of it than they were."

When it comes to consumer attitudes toward inflation, Eric Lascelles, Chief Economist of RBC Global Asset Management, says much has also changed on that front since the '70s.

"It is fascinating to note how differently consumers responded to inflation in the 1970s relative to today. In the 1970s, high inflation was viewed as a reason to pull spending forward, on the presumption that the cost of products would continue to rise rapidly, rendering them even less affordable in the future. In contrast, today, the dominant thinking by consumers is that it is now a bad time to buy things given that their cost has recently risen so substantially," he said in a recent MacroMemo update.

Find the full MacroMemo update at rbcgam.com/macromemo.

RBC Direct Investing Inc., RBC Global Asset Management Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Here’s what we saw on the trading floor in April 2025

Here’s what we saw on the trading floor in March 2025

Making these projections might seem like a black art, but there’s science behind it too