How to Use Your U.S. Dollar Investing Account

Published on November 12, 2021

minute read

Share:

Now that you've learned about the benefits of having two sides to your account — a Canadian dollar side and a U.S. dollar side — let's take a look at how to use your "dual currency" account, including how to covert from one currency to another.

Buy Orders

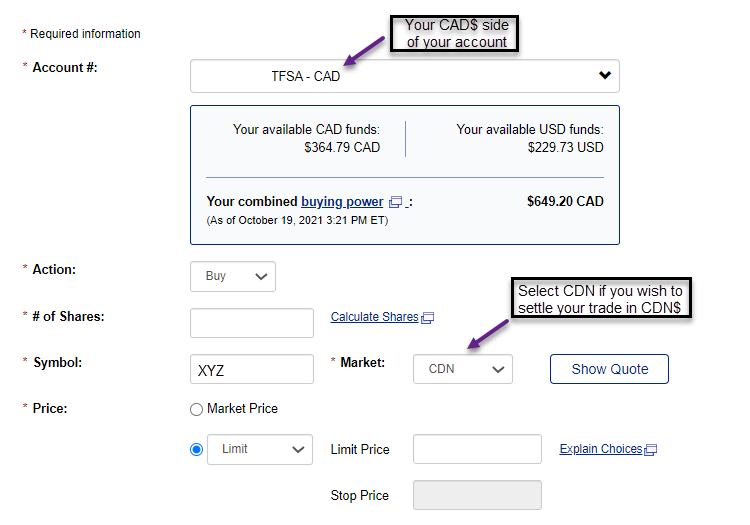

If you choose to purchase a stock in Canadian dollars in the Canadian market, select "CAD" from the Account # dropdown menu, choose "Buy" in the Action field, enter the number of shares to purchase and the symbol of the security, and select "CDN" in the Market field (see example 1 below).

Example 1: Stock buy order placed in Canadian dollars (CAD)

For illustrative purposes only.

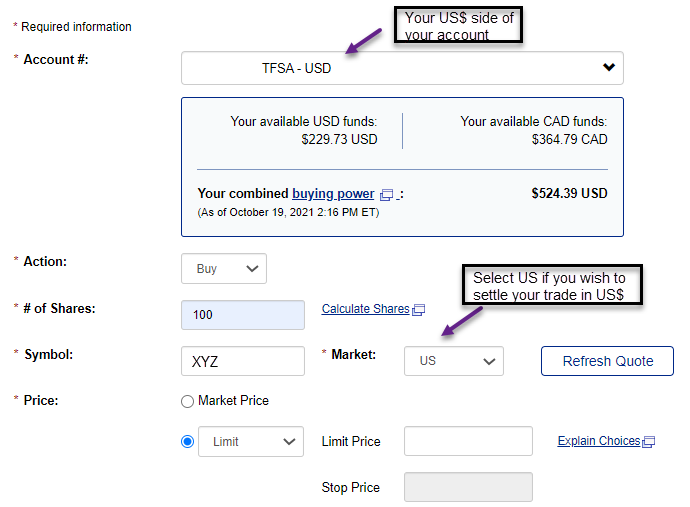

Example 2: Stock buy order placed in U.S. dollars (USD)

If you choose to purchase a stock in U.S. dollars in the U.S. market, select "USD" from the Account # dropdown menu, choose “Buy" in the Action field, enter the number of shares to purchase and the symbol of the security, and select "US" in the Market field.

For illustrative purposes only.

Need to Convert Currency? Foreign Exchange How-To

If you want to buy a U.S. security in U.S. dollars and you only have Canadian dollars, you'll need to convert some or all of your cash into U.S. dollars. Doing a foreign exchange conversion in real time means that you'll know exactly how much you have to spend on your U.S. dollar transaction before you place your trade. You can convert your Canadian dollars anytime, up to and including the settlement date. (Note: real-time exchange rates are available during foreign exchange hours, from approximately 7:45 a.m. to 4:45 p.m. ET on Canadian and U.S. business days. Transactions placed outside of these hours will be pending for the next business day.)

To conduct your foreign exchange, simply select Trade & Transfer > Transfers > Transfer Funds. The same process applies to conversions of U.S. dollars to Canadian dollars. Foreign currency exchange fees will apply when you convert your funds - but having two sides to your account gives you the option to limit your conversions.

Good to know...

- Your available funds to transfer for foreign exchange may be different from the cash balance shown on your Holdings page due to sell orders that haven't settled. To confirm settlement dates, visit Trade & Transfer > Transactions > View Activity

- Foreign-exchange requests processed during foreign-exchange hours can't be cancelled or reversed. Pending foreign exchange requests can be cancelled before the transaction has been processed. To cancel a pending request, go to the Submitted Transactions section on the Activity page

Sell Orders

When placing a sell order, you can choose to settle your trade in either Canadian or U.S. dollars.

If you choose, for example, to receive U.S. dollars when selling a U.S.-dollar investment, select the "USD" from the Account # dropdown menu and select "US" in the Market field.

Debit Balances

If you choose to buy an investment in one currency but only have the cash in the other currency, you will need to convert the cash before the settlement date in order to settle any negative cash balances. Interest is charged and calculated separately for debit balances in each currency. In other words, interest owed on a negative cash balance in one currency will not be offset by a positive cash balance in the other currency within the same account.

In addition, Canadian tax rules prohibit registered plans from borrowing cash or maintaining an overdraft position at any time. When an overdraft is created, your registered plan may be considered to have borrowed. This may result in adverse tax consequences depending on the type of registered plan.

The information provided in this article is for general purposes only and does not constitute personal financial or tax advice. Please consult with your own professional advisor to discuss your specific financial and tax needs.

Next up: What to Know About Having a Canadian and U.S. Side to Your Account

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2021.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.