Understanding TFSAs: What They Are and How You Can Use Them

Published on January 8, 2021

minute read

Share:

Updated November 2025

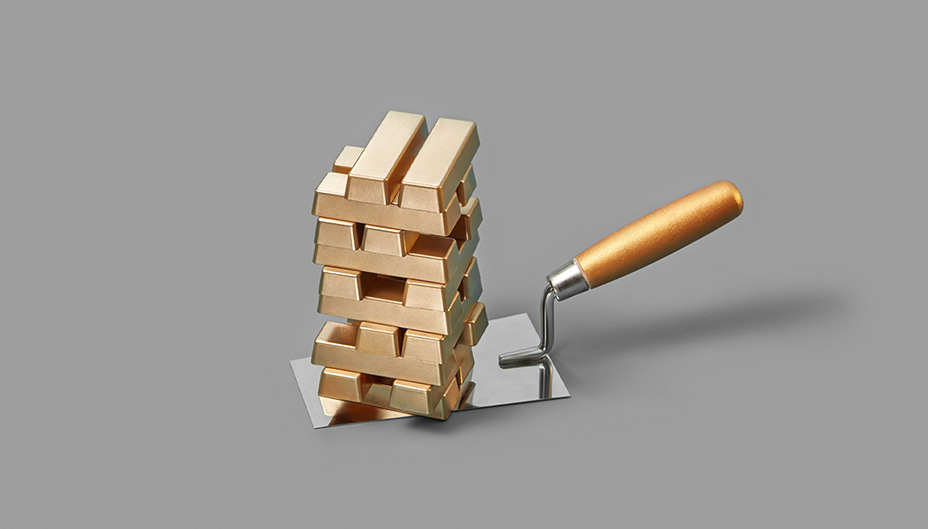

If you're looking for a tax-free way to save and invest, a Tax-Free Savings Account (TFSA) might be the way to go. Let's look at what this account is and how you can use it to invest for your short- and long-term goals.

What is a TFSA?

A TFSA is a registered investment account that allows for tax-free growth of investment income and capital gains from investments held within it.

The Government of Canada introduced TFSAs in 2009 and sets a contribution limit each year. Even if you haven't opened a TFSA, your contribution room started accumulating from when you became eligible for one (more on eligibility below). That means you can "catch up" on any missed contributions from past years.

Here are some specifics to know about TFSAs:

Who Can Have a TFSA?

Canadian residents with a social insurance number who have reached age of majority in their province can open a TFSA. For provinces and territories where the age of majority is 19 — Newfoundland and Labrador, New Brunswick, Nova Scotia, British Columbia, Northwest Territories, Yukon and Nunavut — contribution room starts accumulating at age 18, but the account can't be opened until the age of 19.

Investment Choices for Your TFSA

TFSAs are more than savings accounts. Like most investment accounts, you can hold stocks, options, exchange-traded funds (ETFs), mutual funds, bonds and guaranteed investment certificates (GICs) in a TFSA, as long as they are qualified investments.

It's worth noting that if you choose to hold foreign investments in your TFSA, income received from the foreign investments may be subject to foreign withholding tax. These tax amounts aren't recoverable and may reduce your potential returns. Speak with your tax advisor to learn more, including the impacts of new U.S. tax legislation.

Key Features

The main advantage of contributing to a TFSA is tax-free growth of your investment income (dividends and interest) and realized capital gains from investments within the account. You won't get a tax deduction for making a contribution like you would with an RRSP, but you also won't pay taxes when you withdraw from a TFSA. Plus, you can withdraw any time without penalty.

It's worth noting that if you're actively trading inside your TFSA — say, dozens of times each year — the CRA may consider you a day trader and could classify the account as a business account. If a TFSA is considered to be carrying on a business, there may be taxes imposed by the CRA. Similarly, a TFSA can only hold qualified investments, and if you hold non-qualified investments in the account, you will be subject to penalty taxes, and have to pay tax on the investment income and capital gains earned on the non-qualified investment.

Contributing to a TFSA

Each year, the federal government determines the annual amount that individuals can contribute to a TFSA.

Your overall annual contribution limit takes into account:

- the government's annual dollar limit

- your unused contribution room carried forward from previous years

- any withdrawals or re-contributions you made in previous years

For example:

If the government-set limit was $7,000 and you contributed $5,000 to your TFSA that same year, the remaining $2,000 of contribution room you didn't use would be added to your limits in the future. So, if the government limit the following year was $7,000, your overall contribution limit for that year would then be $9,000.*

*Assuming that you have maximized your annual allowable contributions since 2009.

Tracking Your Contributions

It's important to keep track of your TFSA contributions since there are penalties for over-contributing. Over-contributions are subject to a monthly tax of 1 per cent for each month the excess amount stays in your TFSA.

- You can check your contribution room using CRA's My Account. Note: the CRA account details are not real time and only update once a year, usually near the end of February to reflect your prior year's transactions and your current year's dollar limit.

- You can have multiple TFSAs, but you can't contribute more than your annual contribution limit to all of them combined.

Withdrawing from a TFSA

You can withdraw from your TFSA at any time, for any reason. Withdrawals aren't considered income for tax purposes and you don't lose your contribution room when you withdraw.

Here's how it works: If you make a withdrawal in the current calendar year, the amount of your withdrawal is added to your unused contribution room. You just need to wait until the next calendar year or later if you want to re-contribute the money.

For example:

- You contribute $7,000

- Later that same year, you withdraw $2,000

- The next year or another year in the future, you could add back the $2,000 you withdrew plus the allowable annual amount

For more on how TFSAs compare to other accounts, check out TFSAs, RRSPs and RESPs: How Do They Compare?

To Open a TFSA

If a TFSA is the right choice for you, you can start the process here.

To find out how some investors use their own TFSAs, check out How Do You Use Your TFSA? 3 Personal Stories.

The information provided in this article is for general purposes only and does not constitute personal financial or tax advice. Please consult with your own professional advisor to discuss your specific financial and tax needs.

Next up: TFSA FAQs

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2025.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.