What is an ETF?

Published on February 24, 2020

minute read

Share:

Exchange-traded funds (ETFs) have soared in popularity in recent years, but what exactly are they? Let's take a closer look.

What is an ETF?

Similar to a mutual fund, an ETF is a pooled investment vehicle that owns a basket of underlying securities and divides ownership of those securities into shares. A pooled investment vehicle is simply an investment fund formed by pooling small investments from a large number of individuals.

Quick ETF Facts:

- ETF shares, or units, can be bought and sold on a stock exchange throughout the trading day, like a stock.

- An ETF's underlying securities are largely determined by the investment objective of the ETF. Some common underlying assets include stocks, bonds, commodities and currencies.

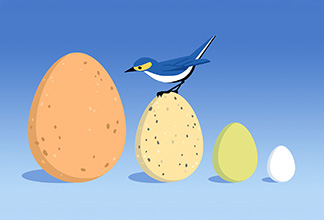

- ETFs are open-ended, meaning units can be created or redeemed based on investor demand. This process is managed by market makers. A market maker is a trader at a bank or brokerage tasked with making firm bids or offers to ensure liquidity is maintained in the market.

- ETFs can be managed a few ways: passively, actively, or a blend of the two.

Active and Passive Management

Passive index ETFs, which offer broad-market exposure by tracking a market index such as the S&P 500, were one of the first types of ETFs created and still represent the majority of ETFs you'll find.

Passive 101

In short, passive investing means tracking the market rather than actively trying to beat the market.

- Passively managed ETFs are constructed to track a benchmark or replicate its performance by holding the same securities as an index in proportionate amounts. They don't seek to exceed the returns, but rather to follow them as closely as possible.

Active 101

Actively managed ETFs look to outperform market returns.

- Actively managed ETFs are those where a manager makes the investment decisions to achieve an objective. Ongoing decisions regarding portfolio construction are made to attempt to outperform the market's return. There are many specialty ETFs that provide unique active management strategies.

Types of ETFs

ETFs can be divided into many categories.

- Index ETFs can include a broad range of securities, such as stocks (domestic and foreign), bonds and commodities like oil and gas or gold.

- Equity ETFs invest in stocks of Canadian, U.S. or international companies. Much like buying stocks and owning shares, equity ETFs have a proportionate claim of ownership on the underlying businesses.

- Sector and industry ETFs include major sectors or segments of the market representing certain industries, such as financials, technology, health care and more.

- Commodity ETFs include specific commodities, such as oil or gold.

- Fixed-income ETFs include broad markets or sectors of the bond market (corporate, government or international, for example).

- Currency ETFs include individual currencies or baskets of currencies from a particular region of the world.

- Real estate ETFs include multiple real estate investment trusts (REITs).

- Thematic or specialty ETFs: The former includes securities based on a theme, and the latter may be leveraged funds, inverse funds or other types.

- Leveraged ETFs use derivatives to achieve daily returns of the underlying asset, multiplied usually by two or three. Similar to any leveraged investment, these types of higher-risk ETFs are designed to magnify gains, which means they also magnify losses.

Remember, there are risks and benefits associated with any investment. It's a good idea to weigh both the risks and benefits when determining if any type of investment is right for you and your situation.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2023.

There may be commissions, trailing commissions, investment fund management fees and expenses associated with investment fund and exchange-traded fund (ETF) investments. On or after June 1, 2022, any trailing commissions paid to RBC Direct Investing Inc. will be rebated to clients pursuant to applicable regulatory exemptions. Before investing, please review the applicable fees, expenses and charges relating to the fund as disclosed in the prospectus, fund facts or ETF facts for the fund. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. For money market funds there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.