30 Years of Canadians Taking Control of Their Investments

Written by The Content Team

Published on October 2, 2019

minute read

Share:

What a difference 30 years make!

Just imagine: In 1989, DIY trading involved calling in for a quote and dictating your order. Off your request went, first scribbled on a form, then entered into a green screen computer and spat out to the exchange via a dot matrix printer (can't you just hear that ee-rr-ee-rr sound?), then shouted by a trader at the top of his voice, and so on.

If this sounds labour intensive, consider what would have led up to your call. Knowing what stock you wanted to buy and at what price meant scouring the newspaper, reviewing hefty financial reports and trips to your local library.

Today, all the information a self-directed investor needs is always at hand (literally, thanks to smartphones), and placing a trade only takes a few clicks.

In creating our “Then & Now” video to commemorate RBC Direct Investing's 30th anniversary, we dug through archives, watched original footage, interviewed the people who were there at every turn, scoured the web (of course) – and totally geeked out along the way. A lot has changed for DIY investors in the three decades since the service got its start in the fall of 1989.

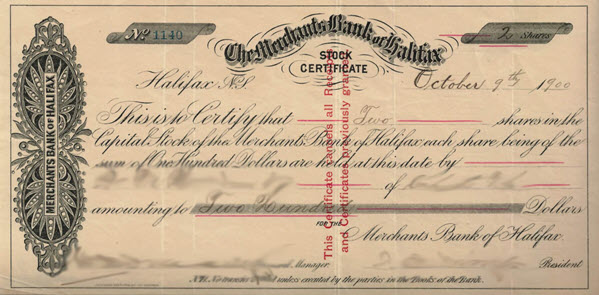

For instance, did you know that securities were traded in fractions before the decimal pricing we now see? That's right, Canadian stock prices used to be quoted as fractions to the nearest eighth. Plus, Canada led North America in the move to “decimalization" in the mid-'90s. And how about stock certificates? The oldest one dates to 1606, but by 1989 that concept hadn't really changed. Holding a stock still meant holding a piece of paper.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2019. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Explore More

7 Ways to Get Ahead Financially in 2026

How you might invigorate your finances and put your money to work more intentionally this year

minute read

Economic Outlook: Uncertainty is Here to Stay, So What's Next?

Takeaways from the Economic Club of Canada’s Annual Event

minute read

3 things: Week of December 15

What the Inspired Investor team is watching this week

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.