Here's How Markets Have Reacted to Conflict Historically

Written by The Inspired Investor Team

Published on February 25, 2022

minute read

Share:

It's no secret that markets don't like uncertainty. It's also no secret that markets have been facing a lot of it lately as a result of the pandemic, inflation fears and more recently, Russia's attack on Ukraine.

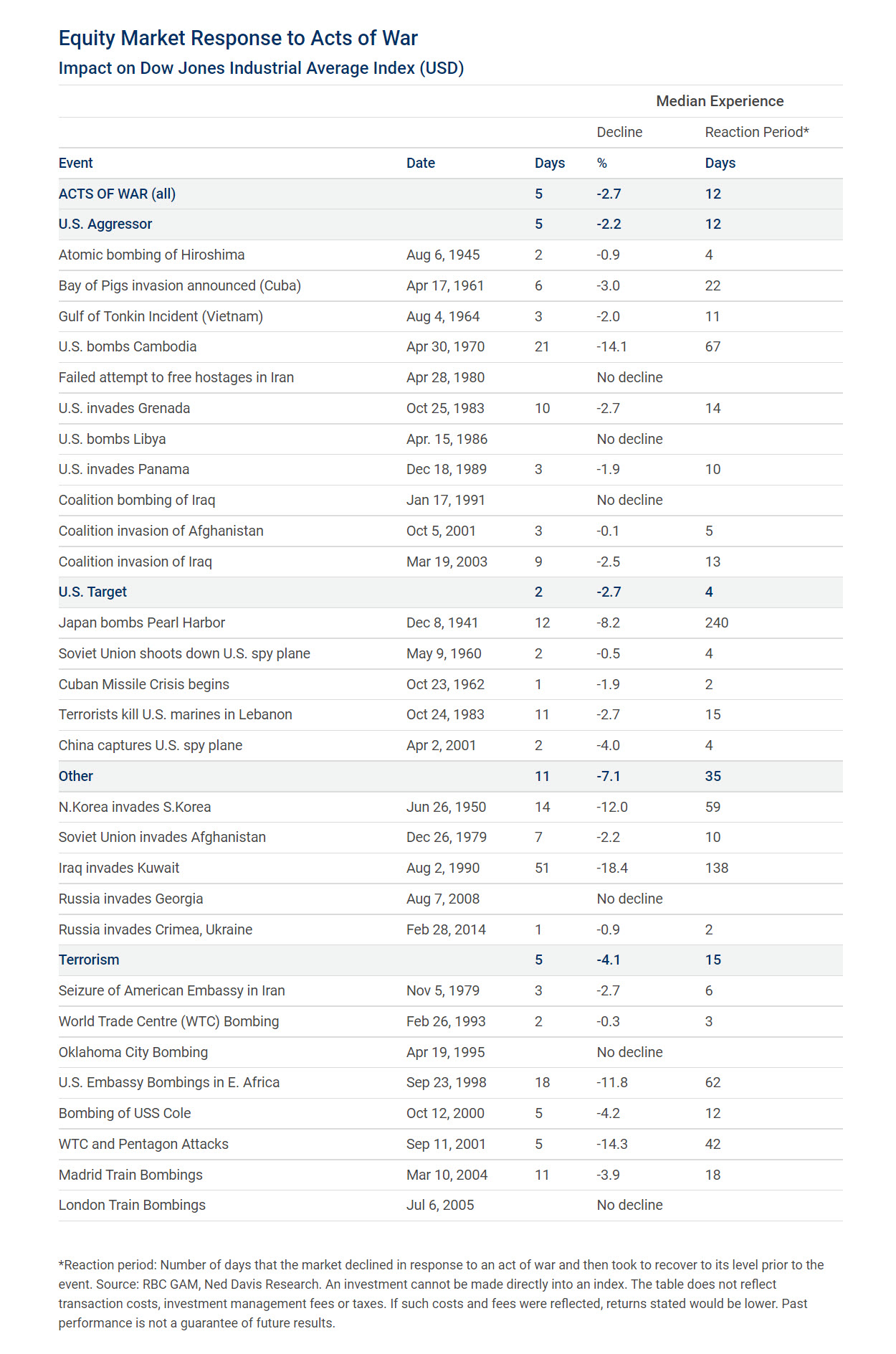

While there's no way to accurately predict how long uncertainties will persist or how markets will react in the future, it can be helpful to take a look back to gauge how markets have responded to major events in the past. With the help of RBC Global Asset Management (RBC GAM), here we'll focus on equity market reactions to acts of war and terrorism.

In a recently released commentary, RBC GAM noted that acts of war rarely have large or lasting impacts on markets, though periods of heightened uncertainty are common. The following chart looks at how U.S. equity markets have reacted historically.

RBC GAM highlights a few specifics to take note of:

- market declines tend to be short, lasting 5-11 days on average, depending on the situation

- the actual change in the market is relatively benign, and often more muted than what investors might believe

Again, while past reactions don't determine what will happen in the future, they can provide some context to help us boost our resiliency as investors when markets are volatile.

RBC Direct Investing Inc., RBC Global Asset Management Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice v. December 2021 6 or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Explore More

7 Ways to Get Ahead Financially in 2026

How you might invigorate your finances and put your money to work more intentionally this year

minute read

Economic Outlook: Uncertainty is Here to Stay, So What's Next?

Takeaways from the Economic Club of Canada’s Annual Event

minute read

3 things: Week of December 15

What the Inspired Investor team is watching this week

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.